NEWS

- Company News

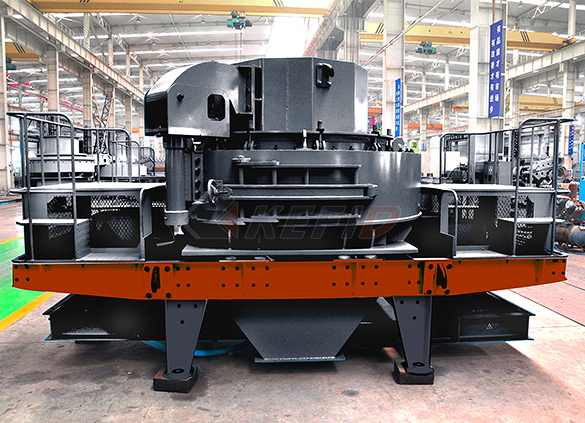

- Kefid's impact crusher models

- Kefid single-cylinder hydraulic

- The equipment configuration and

- The future development of minin

- K series tire mobile crusher

- Bauma China 2020: Three new pro

- Basalt sand and gravel producti

- The crushing mechanism of impac

- The use of coal gangue and crus

- 325 mesh calcium carbonate powd

- Industry News

- The maintenance measures that i

- The standard of mechanism sand

- The technological processes of

- The technical advantages of Eur

- Concrete blocks recycling to bu

- A powerful tool for processing

- Stone crusher for railway proje

- The selection of crushing cavit

- The advantages of mobile sand m

- The solution to prevent corrosi

- Exhibition

- Special Report

- Faq

- How to maintain the production

- How to configure equipment for

- The composition of cement raymo

- I want to buy a coal mill with

- What equipment is needed for th

- What are the complete sets of e

- Regarding the waste disposal af

- What is the price of sand washe

- How much are the accessories of

- What is the reason for the slow

What shall we do in the back of Iron ore price bulls?

Long held assumptions about the direction and dynamics of the iron ore market have been tested in 2014. After hitting a high of $158.90 in February, the industry was jolted on March 10, when iron ore suffered the worst one-day decline since the 2008-2009 financial crisis.The recovery from there was swift, but by June 16 the steelmaking raw material was sliding again, hitting a near 2-year low of $89 per ton. Iron ore has slowly clawed back some of those losses, but remains in danger of trading below $100 on a quarterly basis for the first time since 2009. According to Credit Suisse 62%-equivalent domestic production will decline 16% to 310 million tons this year and drop again in 2015 to 275 million tons. A move back above $100 may not be enough for smaller producers outside China.

Reuters reports a number of miners have already fallen by the wayside including Sweden's Northland Resources, Australia's Cairn Hill and Canada's Labrador Iron Mines. "Iron ore is fast becoming a big boys game, with little room for the small or marginal producer," says Gavin Wendt of Australian consultancy Mine Life. If they want to survive from this price battle, lowering cost will be the best choice. They should corporate with the trustworthy iron ore processing machinery company, engineers available to service machinery overseas After-sales Service Provided and New Condition production line, it is the first step to success in iron ore industry.